What is MagicTradeBot?

Everything You Need to Trade Smarter, Faster, and Safer

MagicTradeBot combines risk-first architecture, intelligent automation, and real-time market intelligence into a single, enterprise-grade trading platform. Designed for serious traders who demand precision, capital protection, and scalable performance.

Core Architecture

Rust-Powered Engine

Built entirely in Rust, MagicTradeBot delivers deterministic performance, true multi-threaded execution, and memory-safe reliability. Designed to handle thousands of symbols with consistent latency and zero runtime degradation.

Zero-Complexity Setup

No database. No external services. No fragile dependencies. Configure once and deploy instantly across local machines, VPS, or cloud servers with minimal operational overhead..

Universal Exchange Support

Trade seamlessly across Binance, Bybit, OKX, Bitget, Hyperliquid, and more using a unified execution layer. New exchanges are continuously integrated without disrupting existing strategies..

Intelligent Symbol & Data Management

Advanced Symbol Sync

Automatically synchronizes listed and delisted symbols in real time. Apply exclusion rules, manual overrides, or full automation to maintain a clean and controlled trading universe..

Massive Scale Processing

Designed to process hundreds to thousands of symbols simultaneously while respecting exchange rate limits. Built for scale without compromising stability or speed.

Multi-Kline Management

Run multiple timeframes and independent strategies per symbol with full isolation. Each kline stream is processed independently to prevent signal interference.

Advanced Signal Intelligence

Real-Time Signal Processing

Signals are evaluated the moment new market data arrives. No polling delays, no batching — just immediate reaction to price action, volatility, and momentum shifts.

Wide Signal Library

Includes technical indicators, volatility detectors, candlestick patterns, and custom signal engines. Designed to surface high-quality setups across all market conditions.

Precision Configuration

Control every signal parameter with granular filters. Reduce noise, enforce strict validation, and trade only when conditions align with your risk profile.

Risk-First Trading Architecture

Multi-Layer Risk Engine

Every trade passes through layered validation: balance limits, leverage caps, volatility filters, cooldowns, DCA exposure control, and emergency rules. Risk is enforced before execution — not after losses.

Global Safety Guards

Define minimum and maximum balance thresholds, max open trades, per-symbol cooldowns, and execution locks to prevent cascading losses during extreme market conditions.

Fail-Safe Execution

Automatic handling of order failures, partial fills, API issues, and exchange anomalies. The system reacts safely without human intervention.

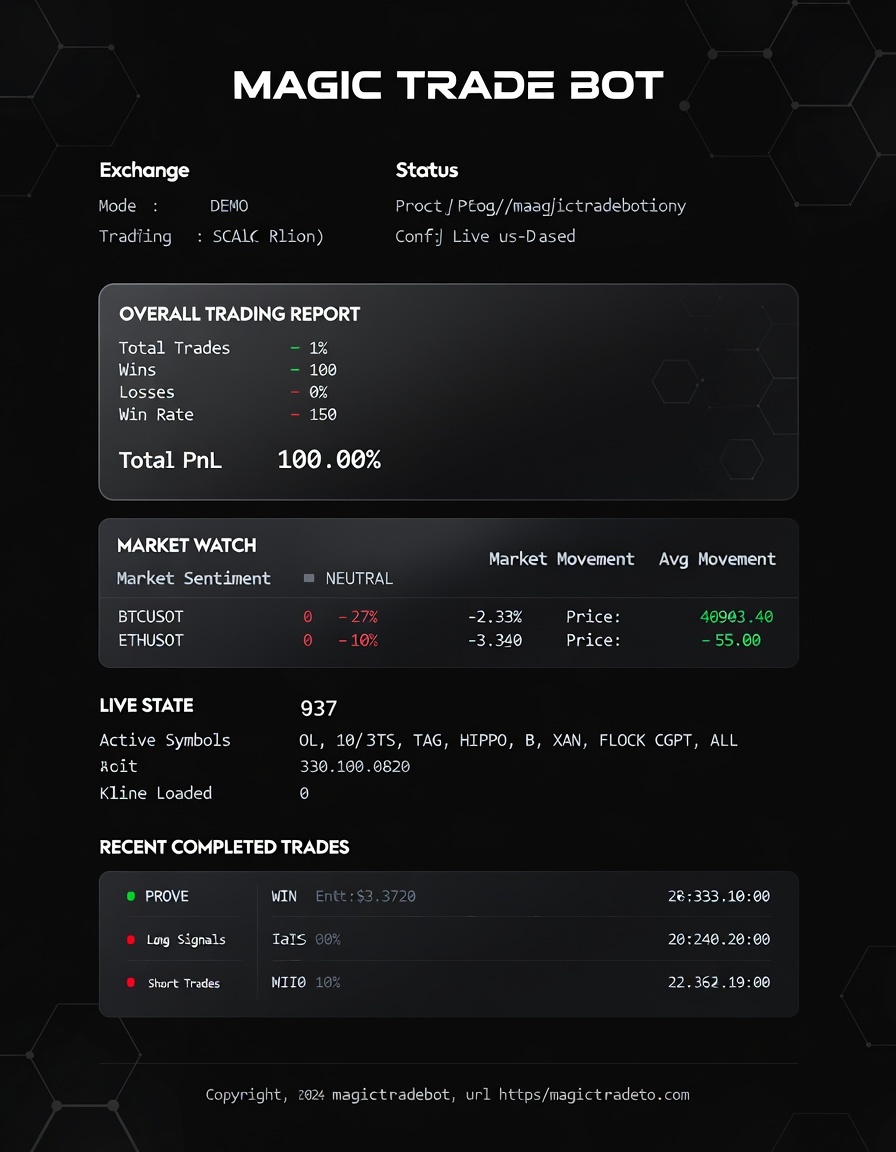

Market Watch Auto-Trading (Pump & Crash Engine)

Extreme Volatility Detection

Continuously monitors abnormal price movements across hundreds of symbols using multi-candle volatility analysis to detect pumps, crashes, and sudden reversals in real time.

Automated Volatility Trading

Automatically opens trades when volatility thresholds are breached. Choose Momentum or Reverse logic, with built-in stop-loss, take-profit, and DCA protection.

Emergency Close & Trade Lock

Instantly closes positions on sharp reversals and locks new trades during chaotic markets. Designed to protect capital when conditions become statistically unstable.

DCA Risk Governance & Capital Protection

Total Exposure Control

Automatically calculates initial order size so that total DCA exposure never exceeds a defined percentage of your account balance — regardless of DCA depth or multipliers.

DCA Governance Rules

Prevents dangerous combinations such as DCA with martingale-based money management. The system enforces capital safety rules automatically.

Balance-Aware Scaling

Position sizing adapts dynamically to balance changes, protecting gains during growth and reducing exposure automatically during drawdowns.

Execution & Risk Management

Advanced Order Placement

Supports market and limit execution with intelligent buffers, time-in-force controls, and automatic cancellation. Built-in safety checks prevent invalid or stale orders.

Smart Stop Loss & Take Profit

Adaptive exit logic that supports fixed, dynamic, time-based, and candle-based exits. Smart SL/TP works seamlessly with DCA, auto-trade, and whale-copy strategies.

Money Management Module

Centralized capital governance with dynamic position sizing, balance thresholds, and exposure caps. Prevents over-allocation while maintaining optimal capital efficiency.

Communication & Analytics

Signal Broadcasting

Broadcast signals, executions, failures, market events, and critical alerts to Telegram, Discord, WhatsApp, or system logs using customizable templates.

Analytics & Reporting

Automatically generates performance summaries, execution metrics, and signal effectiveness reports. Designed for continuous optimization and strategy refinement.

Hyperliquid Whale Copy Trading

Track and analyze large wallet activity on Hyperliquid. Broadcast whale trades or mirror them automatically with strict exposure controls.

Advanced Strategies

Funding Rate Farming

Exploit positive funding rates across exchanges using automated entry and exit logic. Designed for low-risk, yield-focused strategies.

Demo Mode

Simulate live trading behavior without risking capital. Ideal for testing signals, DCA logic, Smart SL/TP, and market-watch automation before going live.

Multi-Instance Architecture

Run multiple isolated bot instances simultaneously. Apply different strategies, profiles, or exchanges without interference.

Enterprise Reliability

Advanced Rate Limit Management

Dynamically adapts request frequency based on exchange limits and market conditions. Maintains data freshness without risking API bans.

Strategy Customization

Configure strategies per instance, per symbol, and per timeframe. Supports scalping, day trading, swing trading, funding farming, and event-driven automation.

Self Hosting

Full control over infrastructure, configurations, and API keys. No cloud lock-in. No third-party data exposure.

Built for professional traders who demand performance, reliability, and scale.

Frequently Asked Questions About MagicTradeBot

Explore detailed answers to common questions about our AI-powered, self-hosted crypto trading automation platform.

What is MagicTradeBot?

MagicTradeBot is a self-hosted crypto trading automation platform designed for speed, efficiency, and full control. It lets you deploy lightweight, intelligent bots to trade across multiple exchanges, execute strategies like scalp or swing trading, copy Hyperliquid whales, and farm funding — all while keeping your data private and infrastructure self-managed.

How is MagicTradeBot different from other crypto trading bots?

Unlike typical cloud-based bots, MagicTradeBot runs entirely on your own server, giving you full privacy and control. It’s built to be lighter, faster, and more intelligent — supporting advanced strategy automation, Hyperliquid whale copy trading, funding farming, and secure enterprise-grade API management.

Can I install MagicTradeBot on my own server?

Yes. MagicTradeBot supports deployment on local machines, virtual private servers (VPS), and private cloud environments. We offer Docker-based setup and full documentation for easy self-hosting.

What are the system requirements for self-hosting MagicTradeBot?

MagicTradeBot is a fully portable trading bot — no database or complex setup required. Just apply your license, configure your preferred exchange using simple YAML or JSON files, and run the executable. It’s lightweight, fast, and runs effortlessly on any modern system (window, mac, linux) or Docker container.

Which cryptocurrency exchanges are supported?

We currently support Binance, Bybit, OKX, Bitget, and Hyperliquid. New exchange integrations are added regularly.

Can I practice trading without using real funds?

Yes. MagicTradeBot includes a Demo Mode that allows you to simulate live trading conditions using virtual funds.

Can I switch between Demo and Live trading?

Yes. You can instantly switch between Demo and Live trading by toggling the DemoMode value in your appsettings.yaml file (DemoMode: true | false). No restart or complex configuration needed — just update, save, and trade.

Can I open and close trades with my favorite Hyperliquid whale trader?

Yes. You can enable the Hyperliquid Whale Copy Trading feature to automatically mirror the trades of one or more of your favorite whale traders on Hyperliquid. Once configured, the system continuously tracks their activity and opens or closes your trades in real time based on their positions and your customized order settings.

How does Funding Farming work?

When enabled, Funding Farming automates your entire bot to strategically earn from positive funding rates. It intelligently selects the top N symbols with the highest funding rates and, based on your budget and settings, opens spot and short perpetual positions. The system continuously monitors market conditions and exits trades automatically when the funding rate turns negative or predefined conditions are met.

How does the smart stop-loss feature work?

Smart stop-loss automatically adjusts as the market moves in your favor, locking in profits and reducing potential losses dynamically.

Can I configure trailing take-profit and OCO orders?

Yes. MagicTradeBot supports advanced trade protection tools including trailing take-profits, stop-losses, OCO (One-Cancels-the-Other), and circuit breakers.

Is there a free trial available?

Yes, we offer a 30-day free trial with access to most features so you can explore the platform risk-free.

What is the pricing for MagicTradeBot?

Pricing starts at $29/month. Visit our Pricing Page for full details and available packages.

What support options are available?

We offer 24/7 access to documentation, an active community forum, and dedicated onboarding support for enterprise customers.